Given India’s dependence on oil imports and US recently over taking China as India’s largest trade partner, one can argue Indian currency has to almost operate in a fixed exchange rate regime with the dollar. With US inflation nearing 9% and measures to reduce money supply via rate hikes and quantitative tightening by the US Fed well-nigh certain a few looming questions present itself to the RBI.

The government has decided to focus on capital expenditure with the FM stating it has a multiplier effect of 2.4.1 While it would be imprudent to argue against expenditure on roads, ports and infrastructure given the supply side constraints that are driving some of the inflation in India, the same paper dating back to 2013 argues the multiplier effect is computed with no constraint on the fiscal deficit. Applying the fiscal deficit constraint in the range of 6-7% as suggested by the Kelkar committee report the multiplier falls to about 1.9.2 This further doesn’t factor in the fiscal deficit of the states, which is now cumulatively around 3.5% of GDP. In effect a total deficit of 10% will significantly bring down the multiplier effect leading to reduced consumption and growth projections.

Further the central government has been continually raising salaries (revenue expenditure) of the civil staff. As recent as last week the PM announced a 10-lakh recruitment drive across government ministries.3 The substitutive nature of the capital and revenue outlay in India, will apply further downward pressure on the net multiplier effect as the revenue outlay multiplier is only a touch above 1.

Adding further pressure to growth is the impending pass through of consistent 10%+ WPI inflation onto consumers. In the June MPC meet RBI based it’s inflation projection of 6.7% with $105 per oil barrel as benchmark.

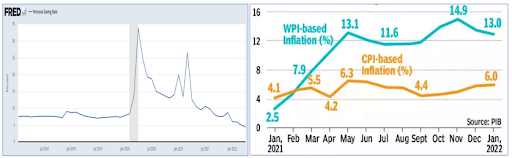

Figure 1: US Personal saving rate (left), India WPI-CPI (right)

Figure 1: US Personal saving rate (left), India WPI-CPI (right)

In totality this means a shortfall in tax collection and failure to maintain fiscal discipline. Will this fuel a current account deficit? The answer to this question is threefold. One, oil prices seem to show no signs of abating and are already well past the $105 that the RBI used as benchmark to call in a 50bps rate hike in it’s June MPC meeting.4 Second, China has just re-opened after several weeks of severe lockdown. The Chinese central bank is unlikely to raise rates and hurt an already lukewarm domestic demand. With most other major economies likely to raise their rates, it will put downward pressure on the Renminbi making Chinese imports into India cheaper. Lastly, despite the 50bps in the June MPC, RBI had to intervene in the forwards market and sell off nearly $10billion treasury bonds after the latest data of US inflation data was 0.5% above expectations.5 As fig1 above shows US personal savings rates have been around 20-30% (well above the standard 5%) consistently for the past 2 years and though it is showing signs of getting back to the usual 5-7% the excess disposable income accumulated in the past 2 years can be expected to keep demand hot6, so much so that the Fed is actively considering a series of 75 bps rate hikes.

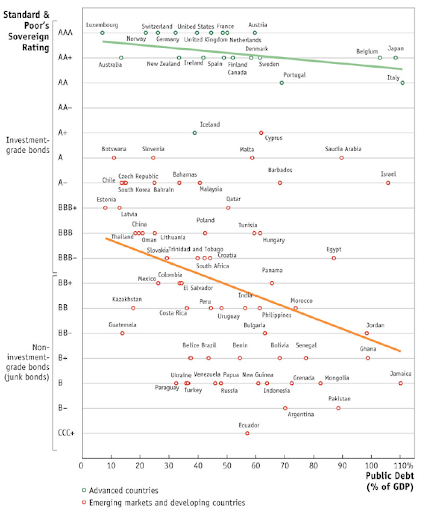

We are staring at a twin deficit problem again and relying on Indian securities purchases to earn the dollars to fund the deficits. The RBI will have to compete with investors rushing for the safe haven of the AAA rated treasury securities and offer rates lucrative enough to purchase our BBB rated bonds. The figure below further accentuates RBIs worries. Historically, the ratings downgrades as a function of debt to GDP ratio have been steeper for emerging economies. With deficits almost certain to rise, RBI will have to worry about ratings downgrades which will further fuel the risk premiums demanded.

Figure 2: Sovereign bond rating and debt levels

Figure 2: Sovereign bond rating and debt levels

In light of the above what measures can RBI take as it looks to hike rates with minimal adverse effect to the GDP. Perhaps some lessons from Alan Greenspan’s well engineered soft landing of 1994 may come in handy.7

Despite a rise in rates the gdp rose thanks to an increase in productivity from the tech boom of the early 90s. In the current scenario the sharp rise in digital technologies could act as the productivity booster. But with most Indian firms primarily focussed on delivering these applications to the US or EU with limited Indian clientele, tech adoption rate is below expectation.

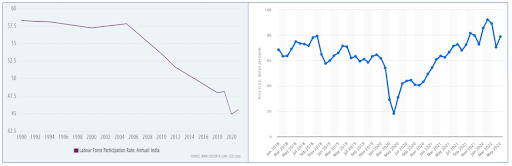

Positive immigration into the US in the 90s gave businesses access to a wider talent pool helping drive the top line up and the bottom line down simultaneously. Flexible working options supported by various video conferencing mechanisms present several opportunities for businesses today. In addition, the labour participation rate in expected to rise from the last month low of nearly 40% – helping alleviate some of the supply side issues firms are facing.9

However recent spate of announcements by state governments ensuring varying degrees of job quotas for the local populace will hurt labour competitiveness.

Lastly, the rise in Russian crude imports to 18% of India’s oil kitty from the pre-war 1%, at ~ $70 per barrel much lower than $120 for crude from the OPEC, will alleviate some of the pressure on current account deficit.10, 11 How long before this is passed on to the consumer is anybody’s guess. Further there is a risk of our refineries deciding to sell the refined oil in the more lucrative oil starved EU market.

Figure 3: India labour participation rate(left) Russian Ural Oil price (right)

Figure 3: India labour participation rate(left) Russian Ural Oil price (right)

With a mix of policy actions and a certain amount of luck the RBI may be able to ensure growth and employment is not scuttled while decelerating the inflation rate with a series of almost certain rate hikes.

2Bose, Sukanya, and N. R. Bhanumurthy, 2013. Fiscal Multipliers for India, Working Paper No. 125, NIPFP, New Delhi (September).

4https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=53832

6https://fred.stlouisfed.org/series/PSAVERT

7Robert C Feenstra, Alan M Taylor – International Macroeconomics pg 441

9https://www.ceicdata.com/en/indicator/india/labour-force-participation-rate

10https://www.statista.com/statistics/1112243/urals-crude-oil-price/

Ram Iyer is an alumni of EPGP 2021-22. He is an automotive SME with Latent View Analytics. In his spare time he enjoys long walks with his own good company, music and cars.