An elective, in a B-school, resembles a living organism to the extent that it needs to adapt itself to the emerging environment if it has to survive. The number of mutations that his elective – New Enterprise Financing (NEF) – has been through, over 21 years, is an example of such adaptation, writes G. Sabarinathan1

A few weeks ago, I wrote a post on the last edition of my elective, New Enterprise Financing2, that I had taught at Indian Institute of Management Bangalore (IIMB). The comments on the post and offline feedback from friends and colleagues made me reflect on the long journey of that elective. It made me want to look deeper into its past than my hazy recollection permitted.

I looked at three documents relating to the various editions of the elective that to piece together a more factually accurate picture. These were the course outlines – which were like a syllabus – that we were required to submit for every elective before it could be taught, the grade sheets that I had submitted, which would tell me the number of students that took the elective in a given edition3 and the fairly detailed notes that I used to write to myself as the elective progressed each time I had taught it.

The picture that emerged was interesting. I will try to capture in this article the more salient features of the picture. I do not believe that what I have to say here is of great academic significance. To the extent that it is rather contextual, it may not have wider applicability or utility. So much so, an average reader could be forgiven for even thinking it is a narcissistic exercise.4

Perhaps one minor detail that may make the story worth narrating is that the development of this story is contemporaneous with the development of the Indian venture capital (VC) and private equity (PE) industries. These industries have emerged as economic phenomena of popular interest during this period. So much so, there are prime time television shows that draw on them. My choices or intentions played no part in the timing of the journey of the elective. For better or for worse, that was purely accidental.

Setting the context: Core, electives and how students choose

Every business school student goes through two types of courses broadly – core or required courses and electives. Required courses form the essential core of the learning in the curriculum. Students do not have a choice about sitting in these courses.

Students choose electives depending on their interest in specialisation. As higher education gets closer to being a market-based activity, the demand for and supply of elective courses has been increasingly following what I refer to as the logic of a market. Thus, some electives are more sought after than others, while a few end-up with no takers at all. Similarly, students’ interest in these electives – the demand – can vary from time to time. What drives the demand is often not easy to figure out.

The system of offering electives at IIMB follows a similar market logic in a way. The implementation of the system is frequently reviewed by IIMB to ensure that it works well for the demand as well as the supply side of electives. The details of the implementation of the market logic at IIMB are not important for my narrative here.

It is worth mentioning that the range and number of electives available is, inter alia, reflective of the quality of education in an institution of higher education. IIMB stands out in this respect in terms of the number of electives it offers across all disciplines. The curricular regime allows a broad range of electives that allows its students to build an eclectic portfolio of courses, across all its various degree-granting programmes.

The birth of an elective

I joined IIMB as an investment professional who wished to try out life in academia.5 Soon after I came on board, the department chair asked me if I could think of an elective that I might start teaching soon, in about a month of my coming on board.

The only elective that came to my mind was something that drew on my experience as an early-stage investment professional. Thus, was born in my head, an elective course that continued to evolve in form and content over the next twenty-one years, that even after I had taught it the last time I described in a LinkedIn post it as work in progress. You can read the post here, if you wish to. https://www.linkedin.com/in/sabarinathan-g-7541a9175/recent-activity/all/

And so here I was, on a cold and lethargic December afternoon in 2000, delivering the first class of my elective which had an unpretentious and, quite possibly, an unappealingly prosaic title, Venture Capital, within weeks of my coming on board as a visiting faculty on a contractual appointment.6 My course was scheduled at what the programme chair at that time described as a “graveyard shift” at 2:00 pm, because of the non-standard duration of the classes I would teach in that first term of that elective. It grew into a more standard duration of twenty classes from the following editions.

Looking back, that first edition of the elective appears so amateurish. The twenty-five students in that class, which included some of the brightest in the institute, were all forgiving; because I cannot imagine that they had learned anything at all, apart from a lot of jargon and their academically non-rigorous meaning.

The next academic year I offered the elective it did not float. It was a scary denouement that potentially put my employment contract with IIMB in peril.7 Fear and anxiety can, within reasonable limits, make one think better, harder. I realised that apart from the unremarkable content and delivery, one of the other possible reasons for the lack of interest in my elective was that the title suggested that the course was meant for those who hoped to make a career in venture capital (VC). And back then in 2000, VC in India was tinier than a cottage industry. With 110 deals funded and $ 900 million of funding committed, not many MBAs would have aspired for a career in Indian VC.

Reimagining the elective Venture Capital

Serendipity struck at that moment as I dealt with an existential struggle of sorts. It was one of those many occasions where my desultory reading habit would help me out. In close succession I had come across this book, Money of Invention: How Venture Capital Creates New Wealth by Paul Gompers and Josh Lerner and the article The Curse of Too Much Capital: Building New Businesses in Large Corporations, by J Clayton, B Gambill and D Harned that had appeared in the McKinsey Quarterly of June 1999.

As I reflected on the book and the article I realised that the processes of VC investing had wider applicability than I had imagined. I came up with a reimagined and redesigned version of my elective. I titled the new elective New Enterprise Financing (NEF). As the title suggested, it was designed to teach the principles and processes of funding early stage enterprises in any setting – be it large companies starting new businesses in-house, companies investing in businesses outside of their organisation or the standard VC or private equity fund making financial investments. The book as well as the article pointed out that those principles and processes were distinct from lending and investing in well established businesses with an operating history.

NEF would differ from a standard course on VC in terms of its focus on investment processes. It would cover the systematic sourcing of investment opportunities, screening them, conducting detailed evaluation, valuation, structuring, contracting, post financing engagement and exits. Every early stage investment professional would follow an operational model that would comprise all of those different stages. The relative emphasis on each of them might vary across investors, depending on the nature of the organisation in which they conducted this activity. It would apply equally even if they were investing their own capital, an activity that is known as angel investing and has become hugely popular. Thus I believed that the contents of the course had wide applicability.

The course would not cover the institutional aspects of raising, managing, harvesting or valuing a VC fund, except to the limited extent that the structure of a fund influenced investment processes, as academic research on VC had pointed out repeatedly. Apart from maintaining a somewhat tight focus on the pedagogic objective of teaching how to make and manage early stage investments, the exclusion of institutional details was also intended to signal to the potential audience that the course did not mean to train them to be VC fund managers.

An elective in entrepreneurial finance draws on two disciplines at the minimum: Entrepreneurial strategy and financial management. NEF was positioned clearly as an elective that focussed on the financial aspects of managing the entrepreneurial venture. It was designed to take off from where a course on entrepreneurial management concluded. That said, it was difficult to discuss aspects of entrepreneurial finance and early stage investing without touching upon the growth strategies of a given entrepreneurial venture. Strategy and finance are tightly coupled in entrepreneurial finance, even more so than in the case of well-established mature firms. Maintaining the inter-disciplinary balance has been an interesting and challenging feature of NEF. So, communicating the elective’s primary emphasis on finance was important to ensure that students who enrol know what to expect in the class, an aspect I will turn to briefly later.

The reception for NEF

Over the years, the elective had been offered to nearly all the three long duration, degree granting programmes at IIMB that have elective courses in their curriculum: The Post Graduate Programme (PGP), IIMB’s flagship two year full time MBA programme, the Post Graduate Programme in Enterprise Management (PGPEM) and its earlier incarnation which have been IIMB’s two year weekend MBA programme for working professionals for the past quarter of a century and the one year full time executive MBA known as the Executive Post Graduate Programme (EPGP).8 A remarkable feature of the IIMB curriculum is that it allows the same elective, with the same academic rigour, to be taught across all the three degree granting programmes.

NEF was offered 26 times in the past 21 years that I have taught at IIMB.9 Across the 26 editions, the elective had around 800 students enrolling for the elective, cumulatively across the 21 years. In three out of the 18 years the elective was offered more than once during a given academic year. Registration for the elective varied from as little as 19 on the lower side to as high as 71 in a couple of years. The average enrolment of 38 students, across all editions, is not flattering, considering that there are electives that have a broader appeal which rack up registrations of a full section of 75 students year on year, some of them running to even two sections in a given year in the same term.10

To be less harsh on myself, I have over time reconciled to these numbers on the grounds that not everyone would have an interest in early-stage financing or VC, including even those who intended to major in finance. Is that really so? Don’t most major corporations, who wish to grow via inorganic growth or through internal entrepreneurship, and consultants in the leading consulting firms, which advise large firms on strategies for growth and innovation, need to understand the discipline of early stage financing? In my opinion they do, as I have often claimed in materials that seek to promote my elective, a common requirement at IIMB. The registration numbers indicate that students did not buy into the pitch in large numbers.11 The lack of a high or uniform interest in the elective is also reflected in the number of times the elective did not float during the period, an aspect I discuss later in this story.

An evolving syllabus

The beauty of the curriculum administration at IIMB is that the teacher gets the freedom to design and evolve the syllabus, as long as it certain meets certain academic standards. Adherence to those standards is ensured at a well-represented committee, which not only assesses the academic calibre of every new course, be it elective or core, but also periodically reviews existing courses. It also examines if the teacher offering the course has the requisite credentials to deliver it.

The freedom allowed me to periodically revise the syllabus of NEF. For example, in the early years, NEF combined topics and cases in project finance with that of start-up financing. Project finance is typically associated with large projects such as infrastructure projects (like a toll toad for example) or large manufacturing enterprises (like an oil refinery). The premise was that both the financing situations had several features in common – extraordinary risks of all kinds that are endemic in the early years of any enterprise. Financial structures, both in early stage financing of large projects as well as small and innovative startups, attempt to mitigate problems such as moral hazard and other instances of strategic behaviour by those managing the enterprises. It was not until 2010-11 that the last vestiges of project financing disappeared from NEF, making it an elective purely built around VC and PE.

The curricular regime also allowed me to make changes to the evaluation protocol that reflected the improved availability of data and other important developments in the entrepreneurial ecosystem. For example, as more and more start-ups raised multiple rounds of funding, or when more start-ups made initial public offerings (IPOs) of their equity shares I introduced a project that students were asked to work on in groups that required them to study a company of their choice and draw lessons regarding those firms’ growth financing strategy from data available in the public domain. When student groups presented their results to the entire class everyone benefitted from the experience of every other group. Such projects may not have been feasible till the latter half of the past decade.

One temptation that I scrupulously avoided throughout out the years was using “war-stories” from my days as a practitioner. This was a tricky choice though. The trouble with war stories is that they are completely dependent on the person who is narrating them. The audience has few, if any, means of validating those stories. At the same time, anecdotes from one’s past experiences can add texture to the discussions on the practice of investing, coming on top of a layer of theory and concepts. I have steadfastly stuck to published cases, articles and text books which have withstood some test of academic rigour so that the student may be sure that they are not being fed some yarn of unverifiable authenticity.

Students have on occasion expressed their disagreement with my approach and wished that they could learn from my many years of full fund life cycle experience – raising and investing funds, managing a portfolio, exiting investments and redeeming capital to the investors in the fund. My response has been that I draw on them when I make closing comments on cases or when I play the devil’s advocate on positions that my students take. For example, I often quote the recommendation that of one of the co-founders of one of India’s iconic software services giant gave me: While it might sound like a romantic notion for all the founders of a start-up to have equal status it is more effective to have a first among equals. Or how, for example, how I learned that the negotiating power of the founders does not lie in their legal rights in an investment agreement. Instead, it lies in what they can bring to the enterprise, or take away for that matter, if a signed contract that is forced upon them is seen to be unfair ex post. I learned that lesson from yet another hugely successful investment in a software services firm.

The growing VC and PE industry in India and its impact on the elective

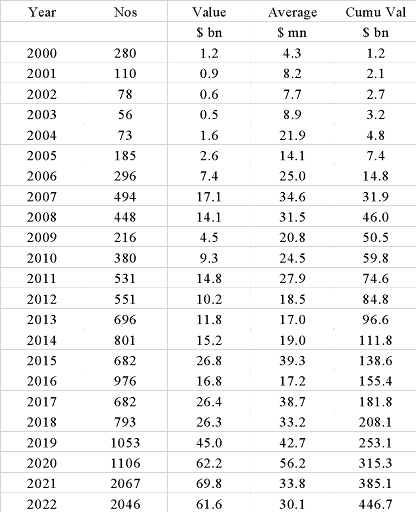

As the VC and PE industry grew in terms of activity level, the syllabus was rejigged, replacing the project financing related material entirely with VC and PE related materials. Table I below presents data on the number of investments made and the dollars of capital committed by VC investors to Indian start-ups.

Table I: VC investment activity in India

Source: Assembled with the help of multiple sources like Preqin, Venture Intelligence, editions of Bain’s report

Source: Assembled with the help of multiple sources like Preqin, Venture Intelligence, editions of Bain’s report

The rapid growth in the industry seemed to impact the elective in three ways. One, the sharp growth in the number of investments during 2005 and 2006 and the resumption of relatively high growth around 2011, after a pause induced by the financial crisis of 2008, generated interest in start-ups among students of business and among the public in general. This was further fuelled by consumer focussed businesses such as RedBus, founded in 2006, which became a popular household name in the field of bus ticketing. Second, as these businesses grew, investors began to increasingly draw on financial structures and terms and conditions used in North America. Those were new to India and caught the imagination of many. Third, as a corollary, stories in the media around these investments and the wealth that they generated piqued the curiosity among observers to understand the working of the early stage financing business. Fourth, the Indian VC market which had for long been held to be a market that provided just one or two rounds of funding at the most,12 was beginning to provide more and more follow on funding, allowing venture funded firms to scale and bulk up. These successes added to the excitement surrounding start-ups. Finally, all of this made a strong case for increasing the depth and breadth of content relating to the funding of early stage enterprises as students started seriously considering a career in VC.

Not all of these were empirically validated back then through formal research. But for those who were keeping track of the exciting, emerging world of start-ups, the buzz was hard to ignore. As an instructor who taught an elective that was designed to be close to practice, and build a bridge between theory and practice, it was important to review the syllabus in response to these important developments. At the other end, the lack of good quality, reliable content also enhanced the appeal of the elective to the students.

What drives student interest in individual electives has always been a puzzle to me, as it has been to many of my colleagues. Enigmas such as these understandably are a fertile breeding ground for conjectures. Leaving aside considerations such as the popularity of the teacher and other idiosyncratic factors such as the term in which the elective is scheduled (or even the days of the week and the time of the day the elective is scheduled) and so on,13 the sharp increase in the enrolment in NEF during that was possibly a result of the combination of a growing interest in the phenomenon, coupled with a lack of reliable content elsewhere.

In the years that followed, the entrepreneurial ecosystem in India in general and VC funding in particular grew even more rapidly. The year 2008-9 is considered by many observers to be epochal as it marks the beginning of the first round of institutional funding of Flipkart, the first major Indian ecommerce start-up that achieved scale rapidly. Flipkart heralded three important trends. One was the possibility of raising large sums of institutional funding across a large number of rounds.14 The second was the pursuit of audacious goals by start-up founders. Going by at least one account available in the book Big Billion StartUp: The Untold Flipkart Story by Mihir Dalal, Sachin Bansal’s decision to shoot for a billion dollars in revenue qualified to be described as a BHAG (big, hairy, audacious goal), an idea propounded by Jim Collins and Jerry Porras in their book Built to Last: Successful Habits of Visionary Companies. The third was that Indian home grown businesses could emulate and adapt for the Indian market, business models of products and services created elsewhere. They could even stand up to global competition when those global pioneers entered India, as Flipkart took on Amazon and Ola competed against Uber. As starting up caught the imagination of many smart young Indians, investment activity also gathered pace. Deal volumes grew, as the table shows, with 2016 being a year of frenzied deal doing, until it started slowing down in 2017 and 2018. That slowdown again was a passing phase.

Exits or the encashment of their investments by investors, were also picking up activity during that activity, although fund managers and other professionals on the funding side of the ecosystem were constantly worried about the limited liquidity and exit options that investors had to contend with.

All of these increased the interest in knowing about VC funding. A host of sources emerged that provided all kinds of information and content – data, insights, workshops, blogs, other social media posts and so on.

The response of the syllabus

As the early-stage investment environment grew and evolved, the syllabus of the elective had to keep pace, given that the outline claimed it was a highly application-oriented elective intended to make the student ready to be functional in the role of an analyst or even a manager who required early-stage investment skills. To a large extent, it also meant that the pedagogy revolved around cases to a large extent. But therein lay the rub, to a certain extent.

Finding that material was not easy to begin with. In the early years IIMB did not have the kind of licensing arrangement that it presently has, which makes cases so much more affordable on a per student basis. While there was a casebook, Venture Capital and Private Equity – A casebook by Josh Lerner it was an international edition, making it financially challenging to order the book in large numbers. As a strong believer in respecting intellectual property, IIMB’s rules were quite strict in terms of reproducing cases and materials from printed originals.

The first three editions of the course therefore ended up relying largely on one case that a professor in the USA generously permitted for use without payment.15 That had to be supplemented by illustrations I cooked up, until IIMB entered into the licensing arrangement that it presently has with Harvard Business School Publishing (HBSP), which makes it financially affordable to include more cases into the syllabus. More recent editions of the elective have had as many as seventeen cases, caselets or specifically targeted readings or notes. Typically ten to twelve out of the twenty sessions were devoted to lectures, the remaining eight – ten to case discussions or a guest lecture, accentuating the high application orientation of the elective.

The second major challenge was the absence of text books or other pedagogic materials that described the processes of making and managing investments. These materials were essential to help the student to acquire an understanding of the practice side of the business.16 In the initial years I had to write up my own notes. With the passage of time, several high quality notes on specific topics such as business models, what top VCs looked for in investment opportunities, term sheets and so on became available. As the demand for content evolved with the growth in the industry, the improved availability was a major shot in the pedagogic arm.17

A third challenge was the periodic revision of the materials that were curated from these sources so as to reflect the kind of industries that fund managers were investing in India and the constantly evolving vocabulary and investment management practices. For example, in the early 2000s, information technology services firms and business process outsourcing firms in India were still an attractive investment opportunity. Come mid 2000s, they were losing their charm because of numerous shifts in the information technology services landscape. Similarly, around the same time, thirty to forty page business plan documents were giving way to crisp and high impact slide decks. The pedagogy had to reflect these shifting preferences in the world of practice in order to remain contemporary and relevant. This was all the more so, because the course had been designed to get the student ready to hit the ground running in a real life investment situation. Needless to state, revision of materials was effort intensive. Over the entire period the syllabus would have experimented with over 30 cases. These in turn had been chosen from over 100 cases and technical notes from the collection that HBSP distributed that were reviewed for inclusion into the syllabus.

Bumpy ride

Notwithstanding the impressive developments in the early stage funding industry, the interest in NEF among students was not always smooth or predictable. In the 21 years that I have taught at IIMB, NEF had been offered 26 times. Five of the editions did not receive the minimum number of registrations required for the course to be taught. That is quite possibly higher than the average across IIMB in terms of electives not receiving the required minimum subscriptions.

Over time I also sensed that the elective suffered from a signalling problem. Students who wished to start up enrolled in my elective, seemingly mistaking it for a course in entrepreneurship that would teach them how to start up an enterprise and grow it.18 Starting 2006-07, I stipulated a minimum grade point average in the two required courses offered by the finance and accounts academic departments at IIMB as a prerequisite to bid for the elective. I saw this as a way of screening in students who would be interested in finance. I introduced the prerequisite to ensure that this elective was perceived to be an elective in finance and not to confused it with an elective on entrepreneurship.

Not surprisingly, the frequency of the elective not getting subscribed increased – four out of the 18 times NEF had been offered with such a pre-requisite. Was it because the students found the pre-requisite too high a barrier to clear? Possibly yes. Was it a pragmatic idea on my part to ask for such a pre-requisite? Possibly not. It was an expediency I had come up with in order to ensure that those who signed up for the elective were aware of the numerically, if not mathematically, intensive nature of the course that was to be expected in a finance elective.19

Certain other interesting patterns emerged in terms of how the course was received among different student cohorts. For example, students from the PGPEM and the EPGP raved about the elective. The course topped the feedback chart a few times among those two cohorts; whereas the response from the two-year PGP was a lot more muted, with the feedback rarely making it to even the top quartile among different electives taught in that term, despite high registrations which indicated students possibly saw academic value in the elective but were not impressed with the instructor.20

Preparing for the swansong

In much the same way a book and an article sowed in my mind the seeds of a new elective, three books and an article – that I wrote this time – set me thinking if it was time to prepare myself for a swansong as far as NEF was concerned.

Around 2020 as I reflected on the profound changes I had been reading about in the VC industry, especially in North America which serves as the fountainhead for investment practices elsewhere in the world, I began to get the feeling that the industry was changing in ways that made it unrecognisable from its own past. That resulted in a lengthy blog post where I noted a few of these changes.

Three books that I read soon thereafter made me think even more deeply about the observations I had made in my article. The Power Law: Venture Capital and the Making of the New Future by Sebastian Mallaby, among other things, traced the way VC funds made and managed investments from its early origins in the fifties, all the way to the beginning of twenties in the new millennium. The Cult of We: WeWork, Adam Neumann, and the Great Startup Delusion by Eliot Brown and Maureen Farrell provided a detailed account of how investors made investment decisions in the case of one start-up and how they dealt with – or did not deal with at all – the post funding governance and other challenges of a rapidly growing capital guzzling start-up headed by an alpha male management team that eventually imploded. The Big Billion Startup, which I referred to earlier in this story served up a similar anecdote around the story of Flipkart.

Several other writings I read, and the stories of the explosive growth in unicorns in India reinforced the hypotheses that were forming in my mind about the future for my elective. As I rehearsed the script for my offering of the elective in 2021, 2022 and 2023 the question that kept coming back to my mind was this: If I claimed to teach my students the practice of early stage financing how close was what I taught to the practices prevalent in the industry?

The conclusion was inescapable to me. The structured approach that I taught in my class did not seem close to what I noticed as the swashbuckling style of many of the contemporary investment managers. This was evident from what the guest speakers in my elective narrated to my students. As I sat through their lectures I would squirm when they talked about how they evaluated investments or wrote the various provisions in their term sheets. It is not that those investment managers were not careful, disciplined or successful. They were merely modifying their craft to be appropriate to the emerging realities of the early stage investment space.21 At the same time my elective did not have the theoretical rigour that drew on the burgeoning volume of literature that academics were adding at a rapid rate and that I had been consuming.

I realised that my elective was not even a decent half-way house between the theory and practice of early stage financing. It would have to inevitably morph into one or the other eventually. It was becoming more and more obvious to me that it would soon be swansong time for the elective in the form that I had run it for the past 21 years.

The feedback that I reported in my LinkedIn post (referred to earlier) was perhaps reflective of the disconnect that the students saw between what I taught and what they read in the media about how investments were being made. The media was after all flooded with stories about companies getting funded, deals going sour, discussions on the role of fund managers and so on. TV shows like Shark Tank fed the adrenalin rush. My elective must have sounded incredibly soporific in comparison. The feedback from the student thus served as the final confirmation that it was time to draw the curtains on the elective. As I taught the last few classes in that edition, I realised this was indeed my swansong as far as the elective was concerned. I thanked God that a product that had had an unlikely start had lasted for 21 years till it was time for me to draw a line under my life as a teacher.

Reflecting on 21 years of work in progress

NEF remains work in progress at the end of 21 years of periodic review and change. Looking back at the way my elective progressed leads me to a few general observations.

One, the idea for a new elective can come from totally unexpected quarters and in entirely unanticipated ways. I still cannot think of any turn of events, other than my serendipitous stumbling upon the article and the book I referred to at the start, leading to the redesigning of the elective that I had started teaching.

Second, an elective resembles a living organism to the extent that it needs to adapt itself to the emerging environment if it has to survive. The number of mutations that NEF has been through, some major and some less so, are examples of such adaptation. Notwithstanding all these mutations, there comes a time when the elective has to fade away from the curriculum. This is especially true for electives that are close to the world of practice. As industries ebb away or morph into something entirely new or different, the elective also has to disappear – until it can reincarnate in a different form or style.

Third, what drives the demand for an elective in business schools remains a mystery. Placement considerations seem to be an important factor. Finance electives become popular when jobs in the finance sector look promising. With the numerous shifts in the sector, fewer and fewer of the kind of finance jobs that students seem to look forward to have been coming to campuses to recruit. And with that students’ interest in finance electives seems to have been declining. Demand for electives built around industry verticals or specific asset classes in the field of finance, like NEF, seems to be more vulnerable to labour market dynamics than more general electives, like for example, on Investments or Financial Markets and Institutions.

Fourth, electives seem to be seen as a package deal comprising the teacher and the contents. So, no matter how great the content, if the teacher is not seen as engaging or reasonable, the elective will not fly. My own experience has taught me that humbling lesson. Equally, no matter how great a rockstar the teacher be, if the job market has no use for the content, the elective may not get subscriptions.

Fifth, and perhaps most importantly, there is this important question: Where does an elective like NEF fit into an academic institution where teaching by its tenured or full time faculty is grounded in research driven or research supported content? Academic institutions consider such content more enduring in terms of shelf life. It uses materials that do not swing or sway synchronously with the changes in the world of practice. There seems to be a corresponding belief that courses that use pedagogy and materials that move in line with changes in practice and equip the student with the skills required to develop into a practitioner belong to the world of skill development or skill building, rather than the imparting of academic knowledge. Such courses are believed to be ideally taught by practitioners who can bring contemporary ideas, practices and examples into the classroom, which a full time academic may not have access to.

Let me take an example which I consider striking. Investment managers routinely use convertible instruments such as convertible preference shares or convertible bonds to structure their funding. They do so for mitigating a variety of risks. At the time of making the investment and thereafter, the most ideal way to value those investments, from an academic standpoint, is to look upon them as financial options because invariably the fund manager has the right to convert those preference shares or bonds, as the case may be, into equity shares in the funded enterprise. It is easy to see why a standard option valuation model should be an obvious method to carry out the valuation. The practitioner’s concern would be that the data that is required to use such a model are not easy to find in an early stage investment in a highly innovative enterprise for which there are no existing comparables in the market and the funded enterprise has no operating history.

A similar sense of surprise seems to come through in an important survey of VC investment professionals that was published in 2019 by Gompers et al.22 The authors make a particular mention of the complete absence of the discounted cash flow (DCF) method of valuing investments, that is at the core of the finance curriculum of any business school. Nearly every year that I have taught the elective, I have had one or more industry managers address my students as guest speakers. My students look shocked when they all have said, with no exception, that none of them has ever used the DCF method to value their investments. Often, practitioners do not use even the computationally less demanding accounting comparables method that is often used to value shares of companies that have some kind of an operating history.

Most academics might therefore be reluctant to take up teaching an elective like NEF. I have often felt that in teaching NEF I have been the proverbial fool rushing into a territory academic angels are reluctant to tread. I highlight this issue because most academics, who attempt to teach an elective similar to NEF will have this dilemma to deal with. To be true to one’s academic colours, one should be imparting knowledge that stands up to academic standards. At the same time, as a teacher you want to deliver learnings that students will put to use on their job. I swung in favour of the application bias, even though it made me often feel like a heathen in episcopal robes.

Finally, for those who assume that academics is a safe haven, protected from the wild gyrations in fortunes that is endemic among commercial offerings in a market economy, the market for electives one might say, at an extreme, is not awfully different from the market for various genres of stand-up comedy. That your elective had a great run this year does not promise much for the next academic year. That could well be a brand new year!-

1G.Sabarinathan, PhD, teaches at IIM Bangalore. The views in this article are his own. The article is meant to be a description of an elective he taught till recently and is not a portrayal of the academic system at IIMB. He dedicates this post to Professors Josh Lerner, Paul Gompers, the authors of the article The Curse of Too Much Capital, J Clayton, B Gambill and D Harned for the decisive part their writings played in the shaping of his elective and Professor Steven Kaplan for sharing his case Visible Interactive. He thanks IIMB for offering a platform to teach an elective that has been a source of sense of fulfilment.

2I use new enterprise and early stage enterprise interchangeably. These are business enterprises which have limited or no operating history. While it is not a requirement, my academic interest is in businesses that have some element of novelty in them, either in terms of technology, business idea or the manner in which they conduct their business. To draw a contrast, a relatively small new enterprise that plans to make plastic utensils like buckets, for example, may not be the typical enterprise I have in mind, although strictly speaking it need not be outside of the purview of this discussion.

3I use the term edition to denote each time I offered the elective. The curriculum at IIMB allows the same elective to be offered more than once in an academic year.

4This story has been written in a language that a professional in the world of business can understand. It does not presuppose a deep understanding of the world of finance or the working of a business school.

5I had worked for eighteen years in industry before I joined IIMB. That included four years in project financing, two years in a strategic planning department of a large financial institution and twelve years in raising, investing, post financing engagement and exiting from early stage investments, more commonly known as venture capital (VC). I had what is known in the VC industry as full life cycle fund management experience.

6In spite of the rapid growth of the VC and private equity (PE) industries over the past quarter of a century, these terms are often used synonymously in India. While I am not entirely convinced about the correctness of the usage I prefer to follow the common practice in this article.

7For those who may be curious, I continued on that contract till 2007 and re-joined IIMB as “permanent faculty” in February 2009.

8Interestingly, although I have spoken on VC and early stage equity financing in a few institutions outside IIMB I have never taught the elective anywhere else. That was not entirely out of choice. I was never invited to do so.

9Of the twenty one years, the elective was not offered during two years of the pandemic, effectively reducing the period to nineteen years.

10The relatively high standard deviation of 22, given a mean registration of 38 across all editions, suggests a high variation year on year.

11It is possible that students bought into the idea but were unsure if the teacher would be able to deliver on the promise. This alternate explanation cannot be ruled out, given my patchy teaching feedback history.

12See for example, India Venture Capital and Private Equity Report 2009: On top of the world, still miles to soar. Report available at: http://www.indiavca.org/ivca_pe_vc_reports.aspx

13If you thought that sounds even more bizarre than one how one decides which movie or stand up comedy show to watch, you are not completely off the mark. Fortunately, that is not always the case; although I have heard a few student representatives offer me those as reasons for the level of interest (or lack thereof) in my elective in some of the years. I believe this applies more to electives like NEF that are viewed as more discretionary than, say, an elective on Leadership.

14This has also been noted in a working paper I co-authored with my students Aditya Muralidhar and Ahana Shetty, Venture capital and private equity investing in India: an exploratory study, Working paper no 542, accessible at https://repository.iimb.ac.in/handle/123456789/7735

15It was a simple, interesting case, Visible Interactive, by Professor Steven Kaplan at the Booth School, University of Chicago.

16This seems to be an important gap even to this date. Teaching materials that are available fall into four broad categories. There are academic text books that discuss processes relatively briefly and focus more on the economics principles underlying the investment process. And then there are practitioner accounts that essentially present the view or approach of the author or his fund. A third category of materials are books written by journalists, which are arguably more objective than those written by practitioners. Their focus on companies or transactions is to narrate a story. Those narratives are valuable; however, they do not make up for a text book that discusses processes, partly because they not be academically orientated. Finally, there are cases and technical notes from sources such as HBSP or Ivey School. Each of them focuses on or illustrates a specific aspect of investment decision making. By curating or assembling a number of them it is possible to build a courseware package. It would still be necessary to have a background material or notes that would tie all these individual pieces of material together.

17While I refer to the demand for or expectations of content, the challenge is that there is practically no way for the teacher to discern the demand or those expectations. The implicit belief that the teacher works with is that if the environment comes up with new practices and techniques for making investments the student could be assumed to sign up for the course in the expectation that they would be covered. A few of the students might be familiar with these developments based on stories in the media.

18Colleagues of mine at IIMB offer an elective that teaches how to start and grow an enterprise.

19The course outline typically alerted students to the need that the course required a fair degree of numerical work. That said, the level of mathematics required was limited to the use of exponents, formulating and solving simultaneous equations, inequalities and basic ideas of statistics that were required to understand and apply theories such as the capital asset pricing model. These requirements are lighter than the requirements for an introductory course in corporate finance in most leading business schools, including IIMB.

20There are debates around whether student feedback is an appropriate metric to assess the academic merits of a course. That is a debate for another day. In the absence of anything better I treat it as the only reliable metric available.

21You can read at this link an interesting article that lays out a practitioner’s considerations while making investment decisions. https://sajithpai.com/exhaust-fumes-or-understanding-startup-valuations/. I must clarify that I may not endorse in entirety the views of the author on valuation, although I fear that it may possibly be the only pragmatic way to approach it.

22You can read the article, How Do Venture Capitalists Make Decisions? Paul Gompers, Will Gornall, Steven N. Kaplan, and Ilya A. Strebulaev https://www.nber.org/papers/w22587 at A more practitioner oriented findings of the research can be found in How Venture Capitalists Make Decisions by Paul Gompers, Will Gornall, Steven N. Kaplan, and Ilya A. Strebulaev available at https://hbr.org/2021/03/how-venture-capitalists-make-decisions.

Dr. G. Sabarinathan is Associate Professor, IIMB.