I remember visiting India in July 2014 after a five-year hiatus and paying Rs. 250 for a haircut in a Mumbai suburb. In January 2023, I visited the locality again and a haircut cost me the same Rs. 250. I am reasonably certain that the barber didn’t charge pro-rata to account for my much-receded hairline over the last decade. This observation could be termed anecdotal. The below snip shot from the app Urban Clap has haircuts prices at about Rs 250 as well. Why have haircut prices not increased in a decade? One may argue that salons can make only so many productivity enhancements to a haircut, thus the output is stagnant.

Figure 1: (left) Screen grab from Urban Clap app showing haircut prices, (centre) Sugarcane juice at Rs 20 in Bannerghatta Park, (right) Sugarcane juice at Rs 30 in Bellandur, Bengaluru Urban

Figure 1: (left) Screen grab from Urban Clap app showing haircut prices, (centre) Sugarcane juice at Rs 20 in Bannerghatta Park, (right) Sugarcane juice at Rs 30 in Bellandur, Bengaluru Urban

The entry level salary of IT freshers is largely around the Rs 3-4 lakh bracket.1 Surely, given the rapid changes to the tech industry, all batches of IT freshers have not been operating at the production frontier constantly for their salaries to not have appreciated at all. In real terms, both the salon and the IT entrants’ incomes are depreciating. In contrast, the sugarcane seller on a busy Bengaluru road (right) earns a good 25% more compared to a similar juice stall at the distant Bannerghatta National Park (left) even while both have comparable productivity. The juice teller on the busy road can quit his job for a better paying role as a bus boy or security agent while the one in the faraway national park has nowhere to go, ensuring lower labour costs. In corollary, the IT engineer can’t ply his trade in a car design centre and the barber has no steel kiln to go to alternatively.

I would be stating the obvious if I were to say we don’t have the factories or infrastructure to employ the barber or the IT techie. IT services are our largest export, touching nearly $180 billion in 2022.2 While IT has been an assured source of dollar reserves for the RBI, services output per hour per unit labour i.e., the outsourcing billing rates, have been around the $30 mark for the past decade.

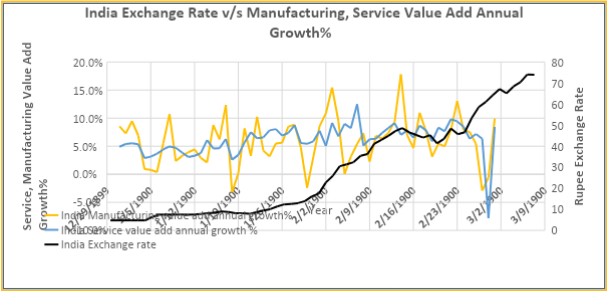

Customers in the US or the EU don’t see added value in paying an extra premium and seeing it as cost optimisation. However, tech stocks have consistently been reporting an increase in revenue in rupee terms (yes, in dollar terms too, but to a lesser extent), thanks to the almost constant exchange rate depreciation since the 1990 balance of payments crisis (on average 4% Y-o-Y). Undoubtedly, the RBI’s policy to stock dollar bonds to ensure predictability in the exchange rate has been successful insofar as cushioning the rupee against volatility3 , but it has not led to value add percentage growth.

Figure 2: India Manufacturing and Service Value Add Annual Growth%

Figure 2: India Manufacturing and Service Value Add Annual Growth%

Apart from IT exports, which constitute nearly 40% of our export pie, India exports refined oil products, mechanical components and spares, raw minerals and pharma generics. A sizeable chunk of the customers for these products are from Africa and South Asia. It is no exaggeration to say that these customers too are as price sensitive as the Indian customer. Neither is the jewel in our crown, the services industry, quoting premiums nor are the remaining generics produced. In summary, our products haven’t found sticky customers.

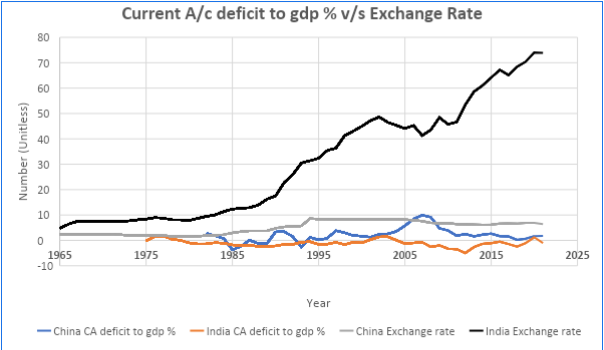

Figure 3: India & China: Current A/c to GDP ratio v/s Exchange Rate to Dollar

Figure 3: India & China: Current A/c to GDP ratio v/s Exchange Rate to Dollar

While exports have increased undoubtedly, thanks to a favourable exchange rate, how exactly it will make up for the current account deficit is unclear. The picture gets murkier with the focus on infrastructure, subsidy incentives based on local production and a recent $2 trillion export target for 20304. Recent FAME subsidy violations by EV manufacturers brings to fore what was already well known – many Indian OEMs import components and assemble them at home.5 These manufacturers don’t have local suppliers to count on and the CAPEX to set up a manufacturing plant with expensive automation equipment imported at unfavourable exchange rate terms acts as a strong dis-incentive. The $2 trillion export target further runs the risk of incentivising a rupee depreciation.

While China has extensively been accused of currency manipulation, the picture above does add a layer of nuance. After trading at about 8 yuan to the dollar from the mid-90s till the turn of the millennium, China sufficiently secured markets for its exports and has been confident that it will appreciate to levels of about six. This confidence is further reflected in the decrease in dollar reserves held by the Chinese central bank since the highs of the 2010s.

This piece seeks to highlight that exports aren’t picking up; the answer to it doesn’t lie with further depreciation, the problems are elsewhere. Our importers are starved of access to expensive foreign heavy equipment. Also, given that the interest rate differential between Western economies and India has narrowed, more of our industrialists will look to raise capital at home. The RBI has reason to not overstock dollars to cover for short-term loan defaults by our importers. This is not to say that the RBI should overnight sell its treasury holdings, but to highlight that 30 years have passed since the foreign exchange crisis and it is time to re-visit a policy framed against that backdrop.

2 https://www.meity.gov.in/it-export

3 https://www.rbi.org.in/scripts/PublicationsView.aspx?id=12252#EXC

Ram Iyer is an alumnus of EPGP 2021-22. He is an automotive SME with LatentView Analytics. In his spare time he enjoys long walks with his own good company, music and cars.