After prolonged periods of near negligible borrowing costs, the last six months have seen a role reversal with interest rates rising faster in the West compared to the East. This article tries to contextualize the volte-face from the perspective of the Anglo-Saxon cousins – UK and Germany.

- Germany, traditionally pro–austerity, has legislated a tax-cut to help tide through the inflation crisis, expected to get worse this winter1

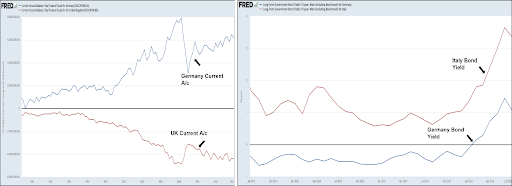

- Manufacturing exports to China have been responsible for Germany’s turnaround from the sick man of Europe in the 90s to delivering consistent positive current account results for the last two decades.

- Italy runs the risk of defaulting on debt after political instability saw bond premiums reach 4%, while the German Bund sold at ~ 1.5%2.

- With demand in China weak and rising premiums on Italian bonds, an ECB rate hike is likely to strengthen the Euro, weaken exports to China and raise the Italian premiums further up. The heavy capital expenditure to diversify away from Russian oil gets costlier too. For now, ECB seems focussed primarily on ironing out the supply side issues to tame inflation.

Figure 1: UK, Germany Current A/c balance (left): Italy, Germany bond yield (right)

Figure 1: UK, Germany Current A/c balance (left): Italy, Germany bond yield (right)

- UK is fresh from an election that saw the PM candidates pitch very different economic plans 3,4

- Liz Truss, the winner, much like Germany, promised her citizens a tax cut to help pay for the rising utility bills this winter.

- Rishi Sunak, the runner-up, had put forth a brave temporary tax hike plan to ~ 25% followed by a wait and watch approach to rescind the hike to current 18%-19% levels in about 6 years.5

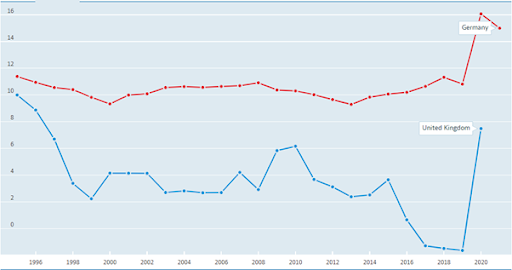

- German households behave starkly different from their cousins across the channel, household savings rate is consistently above 10% while UK lags behind at 3%-5%. To put it in simpler terms, one could call Germany a saver and UK a borrower.

Figure 2: Household savings rate % of disposable income

Figure 2: Household savings rate % of disposable income

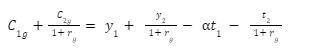

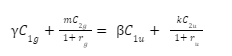

- The above stark differences and the interest hikes in the West lends itself to contextualize UK and Germany with Irving Fischer’s two time period consumption model with Germany (subscript g) and UK (subscript u): Yi, ti, ri and Ci are the respective income, tax, interest rate and consumption in time period i.6

Time period T1: Low interest rates in the West

Time period T2: High interest rates in the West

Germany’s consumption function:

Equation 1: Germany consumption function

Equation 1: Germany consumption function

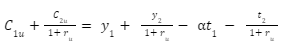

UK’s consumption function:

Equation 2:UK consumption function

Equation 2:UK consumption function

Post the tax break α, instituted by the respective governments, it is fair to assume that both British and Germans would like to maintain similar level of utility. However, given UK is a borrower, more of the tax break is consumed in current time period T1 unlike Germany’s tendency to save a larger proportion of the increased income.

Equation 3: UK-Germany Utility Equality post tax break

Equation 3: UK-Germany Utility Equality post tax break

γ and m are Germany’s changes to consumption in time periods 1 and 2. Respectively, β and k are UK’s consumption shifts.

- γ << β: The borrower UK consumes a lot more in T1 post the tax break

- The above equality holds only if:

- k << m: UK consumption in the future T2 reduces sharply OR

- ru >> rg: UK increases its interest rate well beyond Germany

Needless to say, each of the outcomes of the tax break in UK is detrimental to UK’s GDP prospects. The consumption function further highlights how tough a stance Rishi Sunak took while trying to institute a tax hike, that is, α>1, followed by the promise of a break in time period T2. Any tax hike almost certainly leads to a dip in the net utility function for the consumer, leading to disgruntled voters.

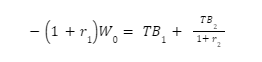

This leads us to the next natural question: How will the Bank of England pay back all the treasury bonds purchased at the higher rates while its own interest earnings from foreign assets reduce?

Equation 4: UK Long Run Budget constraint

Equation 4: UK Long Run Budget constraint

The long run budget constraint above shows that UK will have to turn very soon to a net positive trade balance.7 With home consumption low or experiencing high borrowing costs, the capital investment climate within UK for goods to export is likely to be lukewarm. Herein lies the assumption in Liz Truss’s plan, foreigners will continue to make a beeline to hold UK assets. Would it hold true, is hard to foresee, but the current rush to US as a safe haven and diversification of equities from the UK do not bode well.8 Will the post Brexit efficiencies and reduced red tape promised by Liz Truss motivate firms enough to UK, is what we will have to wait and watch. For now, the goal is to get through the winter and worry about the bills later. God save the King!

References:

-

https://www.dw.com/en/germany-announces-tax-plan-seeking-to-ease-inflation-burden/a-62763562

-

https://www.ft.com/content/78a0a6eb-f325-4527-9652-3203db4bfe16

-

https://www.ft.com/content/61b1f0a5-63cb-4ca0-8b75-e27afc00d106

-

Macroeconomics, Policy and Practice 2nd edition, F Mishkin, Pg 539

-

International Macroeconomics, Robert Feenstra, Alan Taylor, Pg 430

-

https://www.ft.com/content/599cc995-bd51-4d3f-925a-5889f37e21cb

Ram Iyer is an alumnus of EPGP 2021-22. He is an automotive SME with Latent View Analytics. In his spare time he enjoys long walks with his own good company, music and cars.